Data analytics in finance has transformed how hedge funds make investment decisions. What once depended on instinct and experience now relies on structured data, real-time analysis, and predictive algorithms. Hedge fund analysts and data scientists use analytics tools to interpret massive datasets that guide every trade, asset allocation, and portfolio strategy. The precision of these insights gives funds the speed and confidence to act before markets shift. This article explores how hedge funds apply data analytics in finance to gain competitive advantages, reduce risks, and create career opportunities for professionals who can translate data into strategy.

Key Takeaways

- Hedge funds use data analytics in finance to identify profitable opportunities and predict risks with greater accuracy.

- Machine learning, predictive modeling, and alternative data help analysts design more effective investment strategies.

- Professionals skilled in Python, SQL, and financial modeling are highly sought after across Toronto’s hedge fund and fintech sectors.

Understanding Data Analytics in Finance

Data analytics in finance focuses on collecting, processing, and interpreting information that drives investment performance. Hedge funds, investment firms, and financial institutions use analytics to gain measurable advantages in speed, precision, and insight. The process integrates statistical modeling, coding, and financial expertise to make smarter trading and asset management decisions.

In hedge fund operations, data analytics does more than crunch numbers. It evaluates company performance, market sentiment, and macroeconomic trends in real time. Analysts build predictive models that test thousands of variables before a single trade occurs. The result is an evidence-driven system that replaces gut feeling with factual probability.

For professionals, understanding analytics means more than knowing how to use software. You must interpret outputs, communicate results to investors, and translate findings into clear strategies. Courses like Python for Data Analytics Training in Toronto prepare you for this exact skill set, combining programming, business logic, and analytical reasoning to deliver actionable intelligence in financial environments.

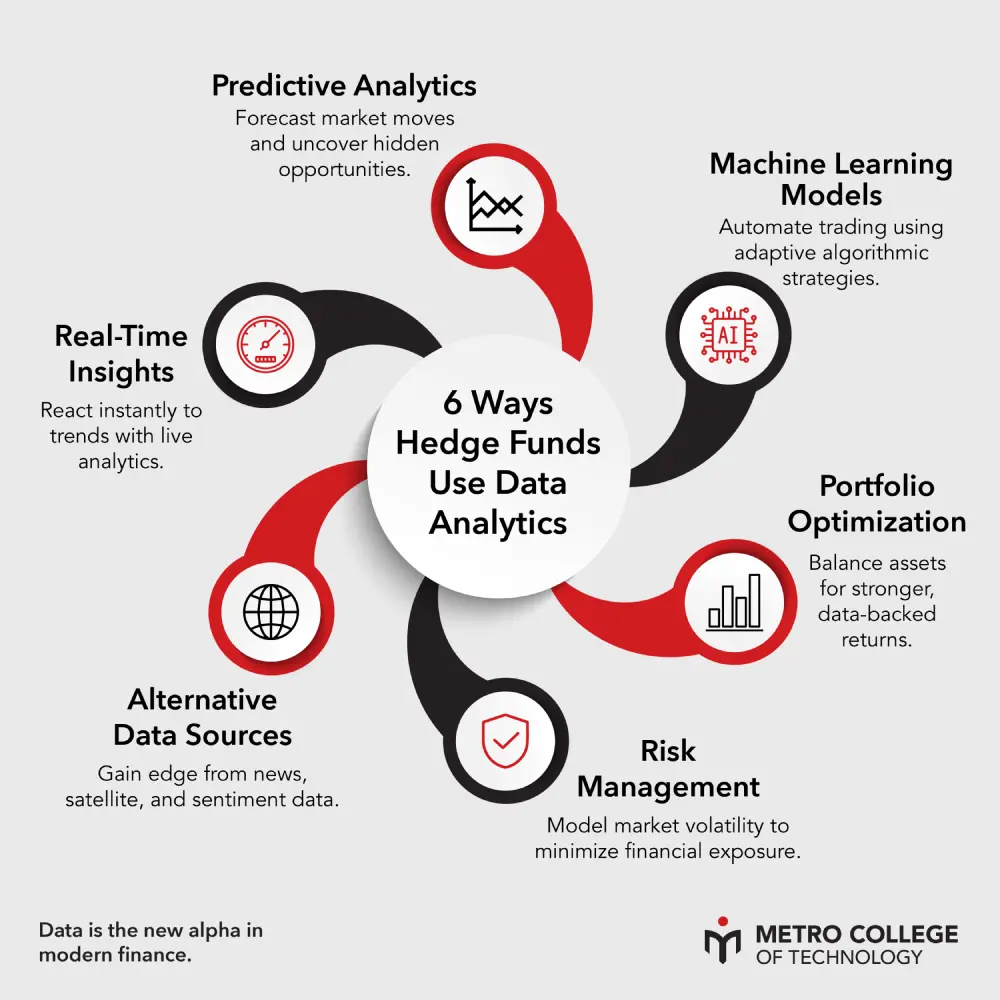

6 Ways Hedge Funds Use Data Analytics in Finance

Data analytics in finance has redefined how hedge funds think, act, and compete. It delivers clarity in markets that thrive on uncertainty. The methods hedge funds use today extend far beyond spreadsheets. From predictive algorithms to alternative data streams, analytics turns raw numbers into structured intelligence. Let’s explore six ways hedge funds apply data analytics to drive stronger investment outcomes and smarter decision-making.

1. Predictive Analytics

Predictive analytics gives hedge funds the foresight to identify emerging opportunities before the market reacts. Using statistical models and machine learning, analysts forecast price movements, volatility levels, and sector performance. This approach replaces instinct with measurable probability, making every investment decision grounded in data. Funds that harness predictive analytics gain the agility to adapt to shifting market trends and anticipate risk rather than simply respond to it.

2. Machine Learning Models

Machine learning sits at the heart of modern trading systems. Hedge funds train algorithms on historical and real-time data to detect complex patterns humans might miss. These models improve through repetition, refining themselves with every new dataset. From regression algorithms to neural networks, machine learning enables automated trading that adjusts strategies based on current conditions. Analysts with Machine Learning and Big Data Analytics training are well-positioned for high-value hedge fund roles that require both technical accuracy and financial insight.

3. Portfolio Optimization

Every hedge fund aims to balance risk and reward. Data analytics transforms portfolio management by using quantitative models to evaluate asset allocation dynamically. Analysts can now test multiple investment scenarios in seconds, identifying which mix of assets yields the best performance under varying conditions. This level of precision helps funds achieve data-backed returns rather than relying on static benchmarks. Courses like SQL Programming Training teach professionals how to build the data pipelines that make this optimization possible.

4. Risk Management

Risk management defines success in hedge fund operations. Data analytics tools model potential losses, forecast exposure, and simulate stress events that challenge portfolio stability. These insights guide fund managers in adjusting positions to safeguard capital. Real-time monitoring and predictive risk scoring enable faster decisions, helping firms mitigate losses while maintaining performance. Advanced statistical platforms and SAS Training enhance analysts’ ability to interpret and control risk across complex investment structures.

5. Alternative Data Sources

In today’s financial world, traditional data alone is no longer enough. Hedge funds use alternative data, such as social media sentiment, satellite imagery, and web traffic metrics, to detect market signals earlier than conventional reports reveal them. This type of analysis provides a competitive advantage, capturing investor behavior and consumer trends in real time. Professionals skilled in Python for Data Analytics and Tableau can convert this unstructured data into dashboards that deliver immediate, actionable intelligence.

6. Real-Time Insights

Markets shift by the second. Real-time analytics allows hedge funds to process data as it streams in, detecting opportunities or threats instantly. Even if it’s currency fluctuations, interest rate updates, or geopolitical news, every second matters. By using high-speed data processing tools, funds can automate trades, reallocate assets, and respond to volatility faster than ever before. This capability defines the next generation of hedge fund strategy and represents the future of data analytics in finance.

Using Predictive Analytics to Identify Investment Opportunities and Risks

Predictive analytics sits at the core of hedge fund decision-making. It uses past data to forecast future outcomes, giving investors an edge in volatile markets. These models study economic patterns, price fluctuations, and company metrics to project how assets will perform in varying conditions.

By applying predictive analytics, hedge funds can model multiple scenarios simultaneously. Analysts rely on advanced tools that simulate market behavior, allowing them to evaluate risks before they occur. Predictive analytics helps firms reduce losses and identify profitable entry points long before competitors react.

Common predictive analytics applications include:

- Market Forecasting: Models estimate potential stock movements by analyzing trading volume, price history, and macroeconomic indicators.

- Credit Risk Assessment: Algorithms evaluate borrower behavior and financial ratios to predict loan defaults.

- Sentiment Analysis: Systems track social media and financial news trends to measure public sentiment on a specific asset or company.

- Fraud Detection: Predictive models identify irregular trading patterns that could signal insider activity or manipulation.

- Volatility Prediction: Statistical tools estimate risk exposure in highly volatile markets, guiding position sizing and diversification.

Predictive analytics transforms hedge fund strategies into measurable, repeatable systems, an essential advantage for analysts entering high-stakes finance roles.

Machine Learning Techniques Used in Hedge Fund Trading Models

Machine learning is reshaping hedge fund trading. It allows computers to recognize complex patterns that traditional models overlook. Hedge funds use these algorithms to process massive amounts of structured and unstructured data, helping them make decisions at lightning speed.

Supervised learning algorithms, such as regression and classification models, predict future returns by learning from historical data. They detect subtle trends invisible to human analysts, increasing both accuracy and efficiency. For example, machine learning models can identify correlations between global news events and currency fluctuations that manual analysis might miss.

Unsupervised learning takes this further by finding hidden structures within data without predefined outcomes. Hedge funds use it to segment assets, detect anomalies, and discover untapped market relationships. Reinforcement learning, where algorithms improve by trial and error, powers automated trading systems that adapt dynamically to market feedback.

Machine learning isn’t limited to hedge funds; it’s also transforming roles across the broader financial ecosystem. Professionals who complete advanced Machine Learning and Big Data Analytics Training programs gain exposure to algorithms like Random Forests, Neural Networks, and Gradient Boosting, each critical for building predictive financial models. These tools combine mathematical rigor with business intelligence, equipping analysts to compete in an industry that rewards precision.

Enhancing Portfolio Management and Asset Allocation with Data Analytics

Portfolio management thrives on balance, risk versus reward, short-term gains versus long-term growth. Data analytics brings clarity to that equation. Hedge fund managers use it to evaluate historical performance, model future returns, and allocate assets across diverse instruments with greater confidence.

Data analytics platforms integrate real-time feeds from global exchanges, alternative data sources, and economic indicators to assess asset correlation. This enables managers to diversify portfolios intelligently, optimizing returns without unnecessary risk exposure. Professionals skilled in SQL, Tableau, and Python are vital in maintaining these data pipelines and visualization systems.

Applications of data analytics in portfolio management include:

- Asset Correlation Analysis: Identifies relationships between securities to minimize portfolio volatility.

- Performance Attribution: Breaks down portfolio gains or losses by asset class, region, and sector.

- Optimization Models: Use algorithms to determine ideal portfolio weightings under varying constraints.

- Scenario Testing: Evaluates how portfolios react to interest rate changes, geopolitical events, or economic shocks.

For analysts entering hedge fund careers, mastering these techniques turns data into strategy, the ultimate differentiator in high-value finance roles.

Strengthen Your Financial Modeling and Asset Analytics Skills

Learn how professionals use SQL, Tableau, and Python to build portfolio optimization models and real-time data dashboards that drive decisions.

Explore SQL Programming TrainingRisk Management and Mitigation Through Advanced Data Models

Every hedge fund faces one universal truth, risk cannot be eliminated, only managed. Data analytics equips financial professionals to quantify and control that risk through simulation, modeling, and continuous monitoring. By combining machine learning algorithms with real-time analytics, hedge funds can detect anomalies and forecast exposure before they escalate.

Analysts use predictive and prescriptive models to calculate potential losses under multiple conditions. These systems rely on structured datasets from global exchanges, interest rate forecasts, and historical performance metrics. They generate probability distributions that reveal where funds are most vulnerable, giving managers the power to rebalance early.

Common risk management applications include:

- Value at Risk (VaR) Modeling: Estimates potential portfolio losses under normal market conditions within a given time frame.

- Stress Testing: Simulates extreme market events to evaluate the resilience of investment portfolios.

- Liquidity Analysis: Measures how quickly assets can be converted to cash without significant value loss.

- Operational Risk Tracking: Detects internal process failures, cyber threats, or compliance breaches before financial damage occurs.

- Monte Carlo Simulations: Randomized simulations that calculate potential outcomes for investment decisions under uncertainty.

For aspiring data analysts and risk professionals, mastering these models builds credibility across banking, fintech, and asset management sectors.

FAQ

What is data analytics in finance, and why is it important for hedge funds?

Data analytics in finance combines statistics, coding, and business logic to interpret massive amounts of financial information. Hedge funds rely on it to forecast returns, manage risk, and outperform benchmarks. Analysts trained in data analytics can convert raw data into profitable trading and investment strategies.

Which programming languages are most valuable in hedge fund analytics?

Python and SQL dominate because they handle data extraction, modeling, and visualization efficiently. Many hedge funds also use SAS and R for statistical modeling. Completing SAS Training in Toronto or Python analytics programs enhances your technical foundation.

How can I start a career in financial data analytics?

Begin by developing technical fluency through structured courses in Python, SQL, and machine learning. Then build a project portfolio that demonstrates your ability to apply theory to real datasets. Many professionals gain experience through internships or research programs in Toronto’s growing hedge fund and fintech ecosystem.

Using Alternative Data Sources to Gain Competitive Insight

Hedge funds now go beyond earnings reports and price charts. They analyze alternative data from social media, satellite images, and online transactions to capture market signals early. This fusion of data science and finance creates new roles for analysts skilled in unstructured data interpretation.

Alternative data reveals market sentiment and corporate activity in real time. A surge in web traffic or changes in geolocation patterns can predict company performance before official reports appear. Training in Tableau and Python for Data Analytics helps professionals turn these insights into clear visual reports for hedge fund decision-makers.

Data analytics in finance depends on speed, precision, and adaptability. As funds expand their data sources, analysts who can process and present these insights will remain at the center of the industry’s growth.

Build Your Python Analytics Foundation with Real Projects

Learn directly from experienced instructors and gain practical, Toronto-focused training that prepares you for real data challenges.

Start Learning Python Today