Data analytics in banking has become one of the most effective tools for detecting and preventing fraud in real time. Banks now rely on advanced algorithms, AI models, and data-sharing systems to track transactions, analyze behaviors, and identify anomalies before they cause financial damage. Every second, institutions process thousands of data points, from withdrawals and transfers to device fingerprints and location histories. By combining machine learning and human intelligence, financial systems are faster, safer, and far more predictive than ever.

Key Takeaways:

- Data analytics improves fraud detection by identifying suspicious patterns across millions of transactions.

- Machine learning enables real-time monitoring, reducing false positives and protecting customer trust.

- Students trained in banking analytics can build careers in fraud prevention and financial intelligence.

The Role of Inter-Bank Data Sharing and Blockchain Technology in Enhancing Fraud Security

Modern banking fraud is increasingly cross-institutional. Criminals exploit gaps between systems to move funds undetected. Inter-bank data sharing solves that problem by creating connected intelligence networks. Banks exchange anonymized transaction data, allowing predictive models to spot fraud rings that operate across multiple financial entities.

Blockchain technology strengthens this collaboration. Its distributed ledger ensures that every transaction is transparent and verifiable. Because each record is time-stamped and immutable, it becomes nearly impossible for fraudulent actors to alter or erase evidence. This technology provides a secure environment where trust no longer depends solely on individual banks but on a shared digital infrastructure.

For students studying analytics, understanding how blockchain integrates with traditional banking systems creates a competitive edge. Canadian banks are investing heavily in digital security, and the demand for data professionals who understand both blockchain principles and fraud-detection models is expanding rapidly.

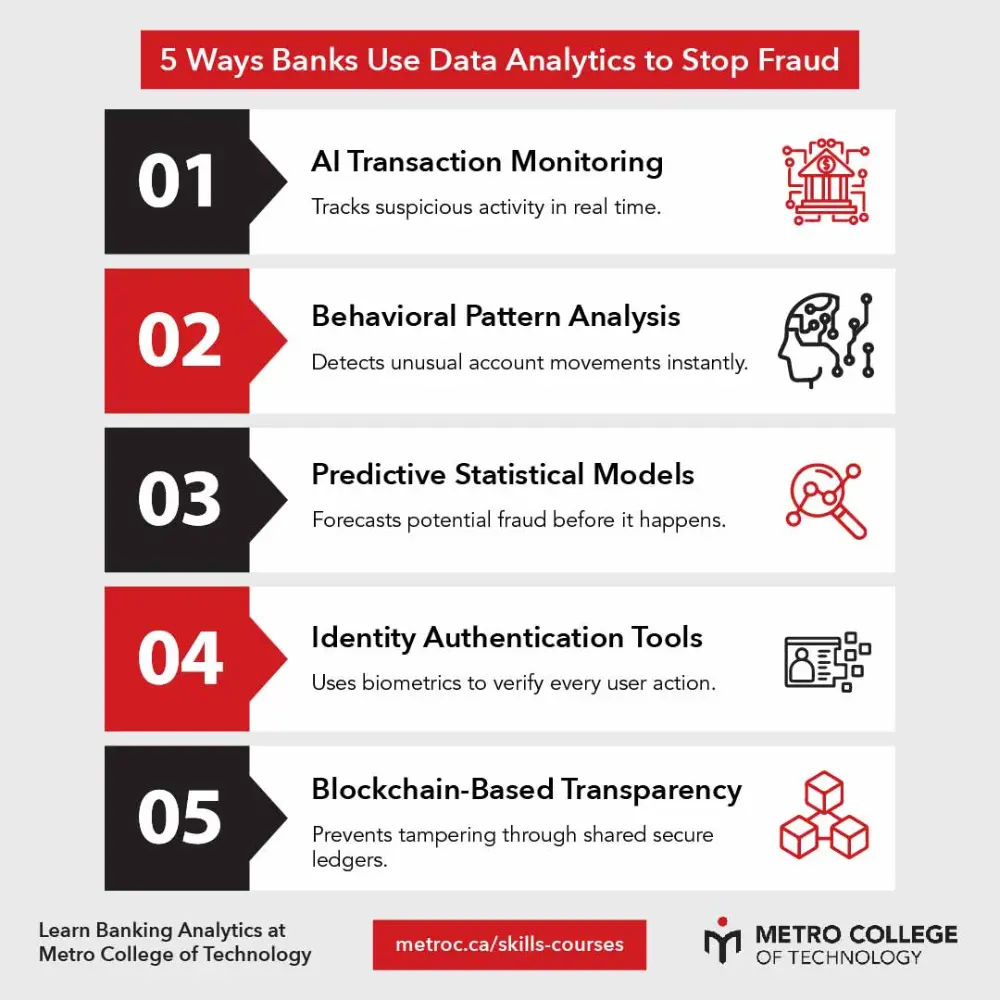

5 Ways Data Analytics in Banking is Used to Detect Fraud

Data analytics in banking merges artificial intelligence, machine learning, and behavioral science to combat financial crime. Banks collect vast amounts of customer and transaction data daily. These datasets feed AI systems capable of learning from past fraud incidents to predict new ones. Below are five advanced methods institutions use to detect and prevent fraud before it escalates.

1. Real-Time Transaction Monitoring with AI and Machine Learning

Real-time monitoring is the first line of defense in fraud prevention. AI models continuously analyze customer transactions as they occur, comparing them against historical data and known fraud patterns. If an inconsistency appears, like a sudden overseas withdrawal or multiple failed logins, the system flags it instantly.

These machine-learning models constantly refine their accuracy. They learn from previous alerts, distinguishing legitimate outliers from real threats. Over time, this adaptive learning reduces false positives, making fraud detection faster and more reliable.

Banks also use geolocation and device-based tracking to validate identity during transactions. If a customer’s card is used in two distant countries within minutes, the AI system triggers a hold on the transaction while alerting security teams. This immediate response minimizes losses and keeps customer trust intact.

2. Behavioral Analysis and Anomaly Detection to Identify Fraud Patterns

Fraud detection isn’t just about analyzing numbers; it’s about understanding human behavior. Data scientists develop behavioral profiles that capture how customers typically use their accounts. These models measure transaction frequency, average spend, location, and device usage.

Once a behavioral baseline is established, anomaly detection algorithms flag irregular activity. A sudden withdrawal of unusually large amounts or purchases from unknown merchants could indicate compromise. The system alerts investigators for review, often before the customer even realizes something is wrong.

Behavioral analytics also uncovers internal fraud. Employees accessing restricted data or performing unauthorized transactions leave digital footprints. By tracking these behaviors, banks can address potential insider threats proactively.

3. Using Advanced Statistical Models to Predict and Prevent Fraudulent Activities

Statistical modeling remains one of the most effective analytical tools in banking security. Regression analysis, clustering, and Bayesian networks identify complex relationships across datasets that human analysts might overlook. These models measure transaction probability and assess deviation risk in real time.

Predictive models can forecast which accounts or geographic regions face a higher risk. For example, a sudden increase in card-not-present transactions from one country may trigger a broader security review. Data scientists then adjust rules to enhance prevention protocols.

By combining statistical models with AI-driven systems, banks balance speed with accuracy. Machine learning handles rapid detection while statistical models provide long-term strategic insight. This synergy strengthens fraud defense across both digital and physical banking channels.

4. Implementation of Identity Verification and Authentication Tools

Identity verification tools add an extra layer of defense. Modern banking systems use multi-factor authentication, biometric scanning, and digital IDs to confirm user legitimacy. These methods prevent fraudsters from accessing accounts even if they obtain passwords or card numbers.

Biometric systems analyze fingerprints, facial patterns, or voice signatures. Because these identifiers are unique, they drastically reduce impersonation risk. Meanwhile, adaptive authentication adjusts verification levels based on transaction sensitivity; simple logins may require passwords, and high-value transfers may need facial scans.

Canadian banks increasingly partner with AI vendors that specialize in digital identity management. These systems analyze user behavior in real time, ensuring smooth experiences for legitimate users while blocking unauthorized access instantly.

5. Using Inter-Bank Data Sharing and Blockchain for Enhanced Fraud Prevention

Data sharing among banks allows early detection of coordinated fraud attempts. By comparing anonymized transaction data, institutions can identify repeat offenders even when they switch accounts across different banks. This shared intelligence improves the accuracy of predictive algorithms.

Blockchain amplifies this security. Every transaction is recorded in an immutable ledger visible to all participating institutions. Because the ledger cannot be altered, fraudulent manipulation of transaction history becomes virtually impossible. This transparency builds collective trust and accountability.

For students entering the financial analytics sector, understanding this dual framework, data sharing and blockchain is critical. It demonstrates how decentralized data ecosystems redefine the way global banks prevent fraud.

Study in Toronto’s Financial Technology Capital

Learn banking analytics and fraud prevention directly from industry professionals. Gain practical skills that help protect the world’s financial systems.

Learn More About Metro CollegeReal-Time Fraud Detection Using AI and Machine Learning

Artificial intelligence has revolutionized fraud prevention. Unlike rule-based systems, AI learns continuously from data, adapting to new attack patterns as they emerge. Real-time monitoring ensures that suspicious transactions are flagged instantly, reducing investigation time and minimizing loss.

Key applications include:

- Automated Fraud Scoring: Assigns risk scores to every transaction based on amount, location, and behavior, allowing immediate blocking of high-risk activity.

- Adaptive Machine Learning Models: Continuously retrain on fresh data to improve prediction accuracy and detect new fraud types faster.

- Cross-Channel Monitoring: Tracks user behavior across mobile, web, and in-branch platforms to identify inconsistencies early.

Canadian financial institutions are leading adopters of these technologies. They use AI systems to process billions of transactions per year. As banks evolve, so does the demand for skilled professionals who can design, train, and manage these intelligent systems.

FAQ

How does data analytics in banking prevent fraud?

It analyzes transaction patterns, customer behaviors, and cross-institution data to identify suspicious activity instantly. Predictive algorithms spot irregularities that indicate fraud, allowing banks to act before losses occur.

What career paths are available in banking analytics?

Graduates can pursue roles such as fraud analyst, risk data specialist, or financial data scientist. Canadian institutions increasingly recruit analytics professionals to design AI models and security frameworks that safeguard transactions.

What skills are essential for a career in banking data analytics?

Professionals in this field need strong analytical and programming skills, particularly in Python, SQL, and machine learning. Knowledge of financial systems, risk management, and data visualization tools like Power BI or Tableau is also valuable. Understanding regulatory compliance and cybersecurity principles gives candidates a strong edge in the banking sector.

Behavioural and Transaction Pattern Analysis for Fraud Prevention

Fraud prevention in modern banking depends on data interpretation. By combining behavioural analysis with AI, banks detect suspicious actions before they escalate into major breaches. Each customer interaction becomes a data point that strengthens predictive accuracy.

The growing integration of blockchain, biometrics, and inter-bank intelligence creates a more transparent and secure financial system. For students pursuing data analytics in banking, this field offers a meaningful way to apply analytical skills to real-world challenges that protect millions of people. Building expertise in fraud analytics isn’t only a smart career move; it’s an opportunity to shape the future of secure global finance.

Study and Work in Toronto’s Thriving Tech Sector

Learn data science, connect with employers, and gain Canadian experience while studying in one of the world’s leading innovation hubs.

Learn About Metro College’s Job Search Assistance