Banks today run on data. Every transaction, credit decision, and compliance report depends on a secure cloud infrastructure. Cloud network security sits at the center of that system, protecting sensitive information as banks expand digital operations and adopt new financial technologies.

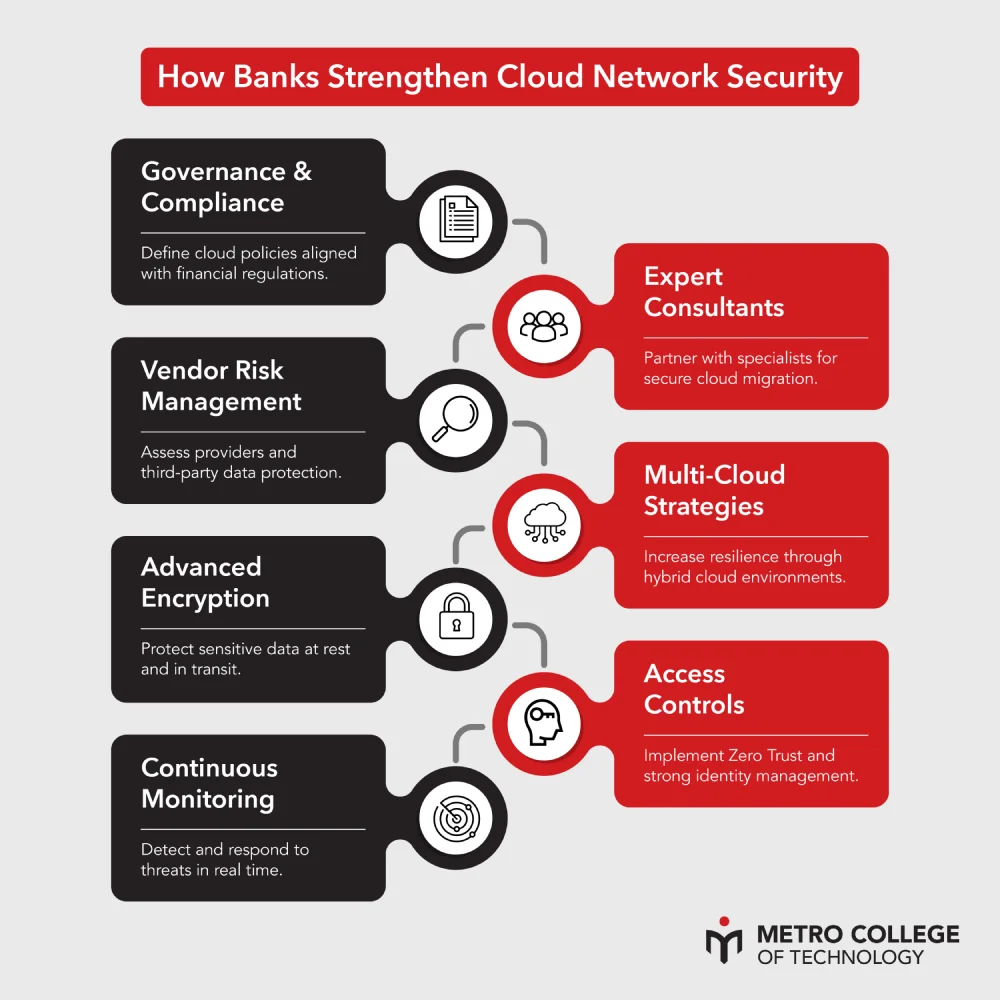

Securing the cloud isn’t just a technical requirement. It’s a strategic necessity. From real-time threat monitoring to advanced encryption, financial institutions deploy layered defenses to prevent breaches and meet strict regulatory expectations. This article explains how banks strengthen their security frameworks through governance, encryption, access control, continuous monitoring, and smart partnerships.

Key Takeaways

- Cloud network security protects sensitive financial data through multi-layered governance, encryption, and monitoring systems.

- Modern banks combine advanced encryption, identity management, and anomaly detection to stay compliant and secure.

- Upskilling in data analytics, SQL, and machine learning equips IT professionals to contribute directly to secure cloud infrastructure.

Establishing Clear Cloud Governance and Compliance Frameworks in Banking

Strong governance creates the foundation of every cloud strategy. Banks define clear compliance frameworks that align with industry regulations such as PCI DSS, GDPR, and local banking privacy laws. Governance sets the tone, outlining how data should be stored, who can access it, and how audits are conducted.

A well-structured compliance framework provides transparency. It ensures that every transaction and file movement is logged and retrievable during regulatory reviews. This level of accountability strengthens both customer trust and operational integrity.

Banks translate that principle into practice by forming committees that review cloud vendor contracts, conduct internal risk assessments, and enforce consistent reporting. A centralized governance model ensures that no policy operates in isolation.

Professionals skilled in SQL Programming often manage these compliance databases, structuring data flows that maintain accuracy while meeting audit standards.

Partnering with Experienced Cloud Network Security Consultants for Financial Services

Banks rarely manage every component of cloud migration alone. Instead, they partner with expert consultants who specialize in secure financial cloud deployments. These professionals bring experience in balancing risk, cost, and regulatory alignment.

Consulting partners evaluate cloud architecture, implement firewalls, and train internal teams to identify vulnerabilities before they escalate.

Effective partnerships extend beyond implementation. Consultants help design security roadmaps that adapt as technologies evolve. Consultants trained in Machine Learning and Big Data Analytics help identify early vulnerabilities through predictive models.

Such partnerships pay off. According to recent financial cybersecurity studies, organizations that rely on external experts report 30% fewer security incidents than those managing in-house systems without external oversight.

Assessing Cloud Providers and Third-Party Vendor Security Risks

Vendor risk management remains one of the toughest challenges for financial institutions. Banks rely on dozens of third-party platforms, from CRM systems to payment gateways, that connect to core networks. Each connection introduces potential exposure.

Best practices include:

- Vendor Assessment Reports: Evaluate every provider’s compliance certifications, such as ISO 27001 and SOC 2.

- Data Segmentation Policies: Ensure third-party vendors maintain logical separation of client data to prevent cross-access.

- Service-Level Agreements: Define measurable metrics for uptime, breach response, and encryption standards.

Continuous review of vendor compliance creates a resilient supply chain, one where data integrity doesn’t rely on assumptions but verified evidence.

Exploring Multi-Cloud and Hybrid Cloud Strategies to Enhance Resilience

Banks no longer depend on a single cloud provider. Modern financial institutions strengthen cloud network security by adopting multi-cloud strategies that distribute workloads across multiple trusted environments. This approach minimizes the impact of outages, reduces single-vendor risk, and ensures continuous service availability, critical for real-time banking operations.

Multi-cloud architectures also enhance threat resilience. If one provider experiences a security incident, banks can shift workloads to another environment without disrupting customer transactions. This diversification gives IT teams more control, stronger redundancy, and better alignment with compliance requirements.

Hybrid cloud models add another layer of protection by combining private and public cloud environments. Sensitive financial data is stored in secure, private infrastructure, while less sensitive applications operate in flexible public clouds. This separation improves data governance, supports regulatory audits, and lowers the attack surface.

To manage these complex environments, banks rely on professionals trained in advanced cloud administration. Many

teams develop their expertise through programs like

Network

Cloud Administration (AWS), which teaches the skills needed to optimize cloud configurations, automate

workload orchestration, and maintain secure connectivity across multiple platforms.

By strategically combining multi-cloud and hybrid cloud approaches, banks build more resilient, compliant, and secure digital ecosystems capable of withstanding modern cyber threats.

Advanced Encryption Techniques for Data-at-Rest and Data-in-Transit Protection

Data encryption protects both stored and transmitted information from unauthorized access.

Encryption algorithms like AES-256 convert data into unreadable code, preventing exposure even if networks are compromised. Multi-factor key management systems further restrict who can decrypt the data, reducing insider risk.

Common encryption strategies include:

- Data-at-Rest Encryption: Secures files stored in databases or backups using symmetric algorithms.

- Data-in-Transit Encryption: Uses SSL/TLS protocols to encrypt traffic moving between users and servers.

- Tokenization: Replaces sensitive data with randomly generated tokens during storage or processing.

Analysts trained in SAS + Python for Data Science often validate encryption workflows by auditing data transfer logs, ensuring compliance with national and international standards.

Access Control and Identity Management Solutions in Banking Cloud Environments

Access management defines who can interact with sensitive data. Banks apply principles of least privilege, ensuring users only access the information they need.

Role-based access control (RBAC) segments permissions based on job function, while single sign-on systems streamline secure authentication. As banks integrate remote teams and third-party apps, identity management becomes more critical than ever.

Access Control Comparison Table

| Method | Purpose | Application in Banking |

| Role-Based Access Control (RBAC) | Assigns permissions by job function | Limits employees to necessary systems |

| Multi-Factor Authentication (MFA) | Multi-Factor Authentication (MFA) | Prevents account compromise |

| Zero Trust Framework | Validates every request before granting access | Protects internal networks from insider threats |

Banks implement least-privilege access, RBAC, MFA, and Zero Trust models. Identity governance teams often receive practical training through programs such as Network Administration (MCSA) and Network Cloud Administration (AWS). These skills help teams manage identity threats and audit permissions.

Conducting Regular Cloud Security Assessments and Audits

Security audits provide the accountability that regulators expect. They ensure that policies align with evolving risks and compliance standards.

Regular assessments validate encryption strength, access control accuracy, and vendor compliance. Automated auditing tools generate reports that track anomalies over time, creating a measurable performance record.

Core elements of an effective audit:

- Policy Review: Verify that cloud security policies align with current laws and internal procedures.

- Vulnerability Testing: Conduct penetration tests and remediation reviews.

- Compliance Documentation: Maintain updated evidence for all cloud components during external audits.

These assessments transform security from a periodic task into a continuous business discipline.

Implementing Zero Trust Architectures for Financial Cloud Security

Zero Trust shifts the traditional “trust but verify” model into “never trust, always verify.” Every device, user, and application must prove legitimacy before gaining access.

In banking, Zero Trust stops lateral movement of attackers who infiltrate one system and attempt to reach others. This architecture integrates network segmentation, identity verification, and behavioral analytics.

Zero Trust best practices:

- Micro-Segmentation: Breaks large networks into smaller segments, minimizing exposure during a breach.

- Continuous Authentication: Monitors behavior patterns to validate user identity in real time.

- Adaptive Policies: Dynamically adjust access rights based on threat levels and location.

With banks processing millions of digital transactions daily, Zero Trust provides consistent protection without slowing operations.

Advance Your Skills in Cloud Security for Financial Systems

Strengthen your ability to secure banking cloud environments with hands-on training in AWS, DevOps practices, and cloud infrastructure controls. Build practical skills that support encryption, monitoring, and multi-cloud governance.

Start Cloud Security TrainingContinuous Monitoring and Real-Time Threat Detection in Bank Networks

Cyber threats evolve faster than static defenses can respond. Continuous monitoring keeps banks ahead of attackers by analyzing traffic and event logs around the clock.

Key components of real-time monitoring:

- Security Information and Event Management (SIEM): Centralizes log analysis to identify emerging threats.

- Behavioral Analytics: Uses AI to distinguish normal patterns from suspicious activity.

- Incident Response Automation: Executes containment and remediation protocols automatically when risk thresholds are met.

Professionals who train in Digital Media Marketing & Analytics can transform these live monitoring results into executive dashboards that visualize system performance and security posture.

Regulatory Compliance Challenges and Solutions in Cloud Security for Banks

Compliance requirements for financial institutions are extensive and constantly changing. Cloud systems must align with national privacy laws, international banking directives, and cybersecurity frameworks.

Meeting these obligations demands coordination between legal, IT, and compliance departments. Automated solutions simplify the process, providing continuous visibility into security status and audit readiness.

Compliance best practices include:

- Data Residency Management: Ensure that storage locations meet jurisdictional requirements.

- Encryption Policy Enforcement: Use uniform encryption standards across all systems.

- Regulatory Change Tracking: Automate notifications when compliance laws evolve.

Professionals skilled in data governance and analytics interpret regulatory data efficiently, reducing penalties and improving customer confidence.

FAQ

Why is cloud network security critical for banks?

Because financial institutions handle sensitive data, robust security prevents breaches, fraud, and compliance

penalties.

What are the biggest threats to financial cloud environments?

Phishing, insider misuse, misconfigured access settings, and supply-chain vulnerabilities represent the top risks.

How does multi-cloud improve resilience?

It distributes workloads across several environments, reducing downtime and increasing operational flexibility.

What skills help professionals enter cloud security roles?

Knowledge of Python, SQL, SAS, and machine learning enhances your ability to manage, secure, and analyze cloud

systems.

How often should banks conduct security audits?

At least quarterly, with real-time monitoring systems operating continuously between scheduled reviews.

Building Resilient and Compliant Financial Cloud Environments

Resilient banking systems depend on disciplined design and continuous monitoring. Cloud network security gives financial institutions the framework to grow confidently in a digital-first economy. By combining governance, encryption, and intelligent monitoring, banks safeguard assets, meet regulations, and build customer trust.

For professionals, the opportunity is clear. Cloud expertise paired with data analytics training opens pathways to impactful, high-demand roles. Through programs like Python for Data Analytics and Machine Learning for Cloud Security, you can master the skills that define modern finance.

Security isn’t a checkbox anymore. It’s a living system, and the banks that treat it that way will lead the financial world of tomorrow.

Become a Cloud Network Administrator for Secure Banking Systems

Learn how to manage cloud access, monitor network activity, and support Zero Trust frameworks across financial institutions. Develop the skills needed to secure multi-cloud environments and protect high-risk banking data.

Explore Cloud Administration