Data analytics in insurance industry has reshaped the way insurers assess risk, detect fraud, and serve customers. What once depended on intuition and static records now runs on predictive models, behavioral data, and artificial intelligence. Today, every claim, every premium, and every policy decision reflects data-driven intelligence.

Insurance companies are no longer reacting to losses; they’re anticipating them. From underwriting precision to personalized products, data analytics provides the competitive clarity that separates modern insurers from legacy players. There are seven major breakthroughs redefining insurance, and how professionals can gain the skills to lead this transformation through advanced analytics and machine learning training.

Key Takeaways

- Data analytics in insurance industry enhances underwriting accuracy, fraud prevention, and personalized customer experiences.

- Predictive modeling and machine learning create real-time insight for faster, fairer, and more transparent insurance operations.

- Upskilling in Python, SAS, SQL, and Tableau unlocks opportunities to contribute to data-driven innovation across the insurance ecosystem.

Advanced Underwriting and Risk Assessment Techniques with Data Analytics in Insurance Industry

Insurance underwriting once relied on historical averages and broad risk categories. Now, with advanced analytics, every applicant’s risk profile is calculated from thousands of variables, income patterns, driving behavior, property conditions, and even social sentiment. This level of granularity changes the economics of risk management.

Modern insurers use predictive modeling to segment customers precisely. Instead of over-charging low-risk clients to balance high-risk ones, analytics ensures fairer pricing. Data from sensors, telematics, and IoT devices feeds machine learning algorithms that learn continuously, improving risk prediction accuracy with every new claim.

Analysts trained in Python for Data Analytics design these models, integrating structured and unstructured data to forecast risk and continuously improve underwriting accuracy. With these techniques, underwriting transforms from static assessment into a living, adaptive decision process that updates with new evidence.

7 Data Analytics in Insurance Industry Breakthroughs

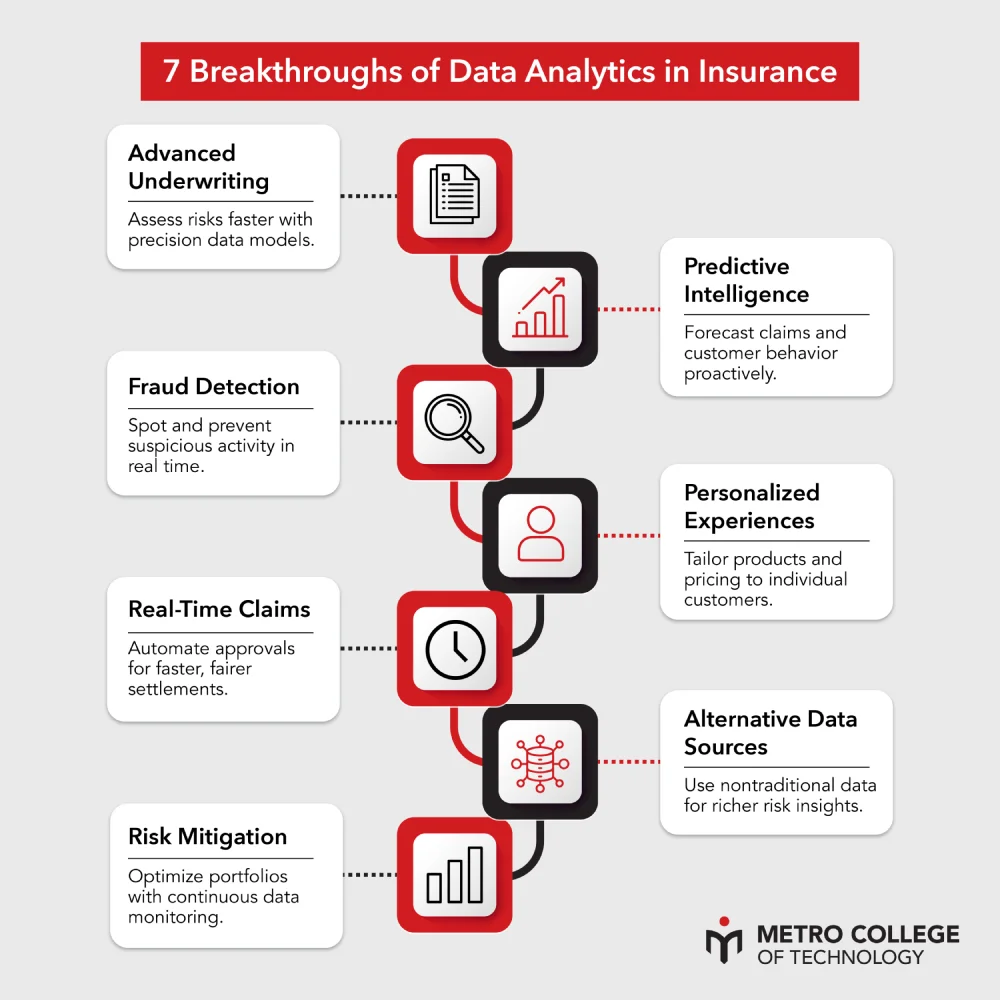

The insurance sector has entered an era of measurable intelligence. Data analytics drives efficiency across every operational layer, from quote generation to claim resolution. These seven breakthroughs highlight where innovation delivers measurable impact: advanced underwriting, predictive intelligence, fraud detection, personalization, real-time automation, use of alternative data, and smarter portfolio optimization.

1. Advanced Underwriting and Risk Assessment

Advanced underwriting represents the foundation of insurance modernization. By analyzing customer demographics, lifestyle, and historical claims, insurers price policies more accurately and identify emerging risk groups early.

Predictive modeling and granular segmentation enable insurers to price more accurately. Professionals trained using SAS + Python for Data Science can build logistic regression and probability models used in modern underwriting systems. This reduces uncertainty and makes sure that pricing aligns with actual exposure rather than outdated averages.

2. Predictive Intelligence for Proactive Decision-Making

Predictive analytics enables insurers to anticipate risk rather than respond after losses occur. By monitoring real-time data streams, carriers can predict claim frequency, adjust premiums, and guide preventive behavior among policyholders.

Machine learning models trained through Machine Learning & Big Data Analytics learn from patterns invisible to traditional actuaries. This proactive approach improves ROI by minimizing avoidable claims and enhancing customer retention through smarter product recommendations.

3. Fraud Detection and Prevention

Fraudulent claims represent one of the largest cost drains in the industry. Data analytics enables early detection by scanning millions of records for suspicious correlations. Algorithms analyze claim patterns, claimant relationships, and irregularities. Fraud scoring systems use Python and SQL automation often supported by training such as Network Cloud Administration (AWS).

Instead of relying on manual audits, insurers now deploy predictive fraud scoring systems that rank each claim by probability of deceit. This accelerates legitimate payouts while reducing false claims, preserving trust between the company and client.

4. Personalized Customer Experiences

Customers expect insurance experiences as smooth as their favorite e-commerce platforms. Data analytics allows personalization that meets those expectations. By analyzing browsing behavior, claim history, and interaction records, insurers craft policies that match individual life stages and preferences.

Personalization also extends to communication. Predictive engagement models determine when a customer is most likely to renew or explore add-on coverage. Insights gathered through real-time data allow insurers to tailor policies and recommendations. Visualization is often performed by analysts trained in Digital Media Marketing & Analytics.

5. Real-Time Claims Processing and Automation

Automated claims processing has reduced settlement times from weeks to minutes. AI systems read reports, validate documents, and assess damage through image analytics. When combined with predictive modeling, these systems decide approvals instantly for low-risk claims.

The result is faster service and greater customer loyalty. Insurers gain operational savings, while clients enjoy seamless claims without friction. AI accelerates claims processing through document scanning, validation, and image analytics. Professionals supporting these automations often train in SQL Programming (MCSA).

6. Use of Alternative and Big Data Sources

Traditional data, credit reports, medical records, and driving histories, tell only part of the story. Alternative data, such as social media sentiment, geolocation, and IoT device readings, adds valuable behavioral insight.

This broader dataset allows underwriters to detect emerging risks like cyber exposure or lifestyle-driven claims frequency. Analysts skilled in Python and machine learning merge structured and unstructured inputs to create unified data environments that reflect reality more accurately than any survey could.

7. Enhanced Risk Mitigation and Portfolio Optimization

Portfolio optimization ensures that insurers maintain balance across risk categories and geographies. Data analytics measures exposure across lines of business, enabling dynamic reallocation of resources.

For instance, predictive portfolio analysis might reveal that property coverage in coastal regions carries higher volatility than inland auto insurance. Adjusting exposure improves stability and profitability. Advanced risk models powered by SAS and SQL integrate this intelligence into investment and reinsurance decisions, strengthening long-term performance.

BBecome the Analyst Who Shapes the Future of Insurance

Develop practical skills in machine learning, predictive modeling, and big data analytics to strengthen underwriting, fraud detection, and risk evaluation across the insurance lifecycle.

Start Machine Learning TrainingPredictive Analytics Transforming Insurance Underwriting Processes

Underwriting defines an insurer’s profitability. Predictive analytics redefines how underwriters assess applicants and price products. By using regression analysis, clustering, and neural networks, underwriters identify precise risk groups and streamline evaluation.

Predictive models replace guesswork with probability. For example, health insurers use models trained on demographic and medical data to forecast chronic illness risk. Auto insurers integrate telematics to evaluate driver safety in real time. The combination of actuarial expertise and data science ensures that pricing aligns with individual behavior instead of broad population trends.

This transformation also improves fairness. Predictive analytics eliminates unconscious bias by relying on statistical evidence rather than subjective judgment. Policyholders who adopt safe habits or maintain healthy lifestyles receive accurate, data-backed discounts. Professionals trained in Python for Data Analytics and SAS gain the skills to build these scoring models responsibly, combining mathematical rigor with ethical oversight.

AI-Driven Fraud Detection and Claims Mitigation Models

Artificial intelligence reshapes fraud detection across claims management. By automating risk scoring and cross-checking databases, AI reduces manual workload and human error. Claims processing becomes faster, safer, and more consistent.

Core applications include:

- Pattern Recognition: AI detects irregular claim patterns by comparing them with millions of verified transactions.

- Image Analysis: Systems examine photos of damaged property to identify inconsistencies between reported and actual loss.

- Network Analysis: Links between claimants, vendors, and policyholders reveal organized fraud networks invisible to humans.

- Natural Language Processing: AI reviews claim notes for suspicious language or repetitive narratives.

Upskill for the Future of Insurance Analytics

Master SQL, visualization, and analytics techniques to interpret claims data, detect fraud, and support smarter insurance decisions. Build dashboards that bring insurance insights to life.

Explore Analytics TrainingFAQ

How does data analytics improve decision-making in insurance?

It provides evidence-based insight into pricing, risk, and fraud detection, allowing insurers to make faster, smarter decisions that reduce costs and improve customer satisfaction.

What technical skills are most useful in insurance analytics?

Python, SAS, SQL, and Tableau are widely used for data management, visualization, and predictive modeling across major insurance firms.

How can beginners start a career in insurance analytics?

Start by enrolling in programs like Python for Data Analytics Training in Toronto or SAS Training to gain foundational analytics skills applicable across risk and claim departments.

What are the biggest benefits of AI in insurance?

AI improves speed, accuracy, and fraud prevention by automating decision processes while ensuring consistency and fairness across claims.

How does big data impact insurance product design?

It helps insurers understand customer behavior, enabling the creation of tailored products and pricing models that reflect real-world patterns rather than assumptions.

Protecting People Through Data Analytics in the Insurance Industry

The insurance sector’s mission has always been protection. Data analytics in insurance industry amplifies that mission by transforming protection into prediction. Every model, dashboard, and insight contributes to a safer, more responsive system that serves customers with fairness and precision.

From underwriting accuracy to fraud prevention, analytics bridges the gap between risk and security. As data volumes grow, the demand for skilled professionals grows with it. By mastering Python, SQL, SAS, and machine learning through Metro College, you position yourself at the intersection of data and decision, where the next generation of insurance innovation begins.

With analytics guiding the industry forward, protection becomes smarter, faster, and more human.